Top 12 tax havens for US companies + Important Info for Uk also!

Britain’s top companies channeling billions of dollars to safe havens to avoid tax by PressTV

Top 12 tax havens for US companies + Important Info for Uk also!

Top 12 tax havens for US companies + Important Info for Uk also!

Map of tax havens, using the 2007 proposed "Stop Tax Haven Abuse Act", US Congress, list of tax havens

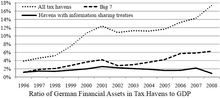

The ratio of German assets in tax havens in relation to the total German GDP.[1] The "Big 7" shown are Hong Kong, Ireland, Lebanon, Liberia, Panama, Singapore, and Switzerland.

According to other definitions,[6] the central feature of a haven is that its laws and other measures can be used to evade or avoid the tax laws or regulations of other jurisdictions. In its December 2008 report on the use of tax havens by American corporations,[7] the U.S. Government Accountability Office was unable to find a satisfactory definition of a tax haven but regarded the following characteristics as indicative of it: nil or nominal taxes; lack of effective exchange of tax information with foreign tax authorities; lack of transparency in the operation of legislative, legal or administrative provisions; no requirement for a substantive local presence; and self-promotion as an offshore financial center.

A 2012 report from the Tax Justice Network estimated that between USD $21 trillion and $32 trillion is sheltered from taxes in unreported tax havens worldwide. If such wealth earns 3% annually and such capital gains were taxed at 30%, it would generate between $190 billion and $280 billion in tax revenues, more than any other tax shelter.[8] If such hidden offshore assets are considered, many countries with governments nominally in debt are shown to be net creditor nations.[9] However, the tax policy director of the Chartered Institute of Taxation expressed skepticism over the accuracy of the figures.[10] A study of 60 large US companies found that they deposited $166 billion in offshore accounts during 2012, sheltering over 40% of their profits from U.S. taxes.[11]

No comments:

Post a Comment